Shared Responsibility Mortgage℠

A responsible mortgage for responsible borrowers

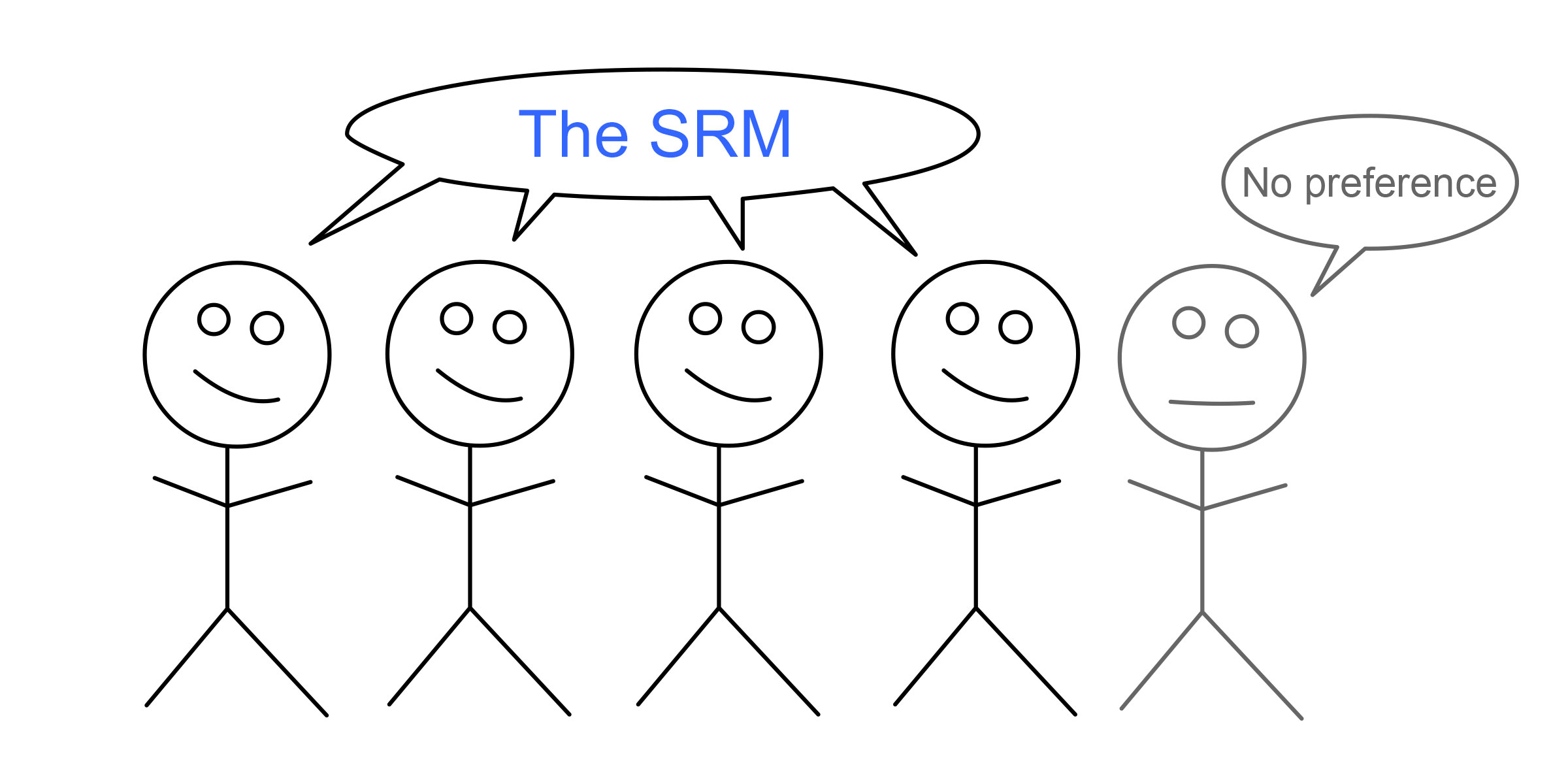

70% of surveyed borrowers prefer the SRM.

"The Shared Responsibility Mortgage could help bubbleproof the housing market"

A responsible mortgage for responsible borrowers

70% of surveyed borrowers prefer the SRM.

"The Shared Responsibility Mortgage could help bubbleproof the housing market"

Many of the factors that determine the value of your home are beyond your control. In 2008, home prices fell 30% nationwide at no fault of any homeowner.

If your local market causes your home's value to fall, most mortgages will expect you to pay the same monthly amount. Over time, these above-market costs can add up.

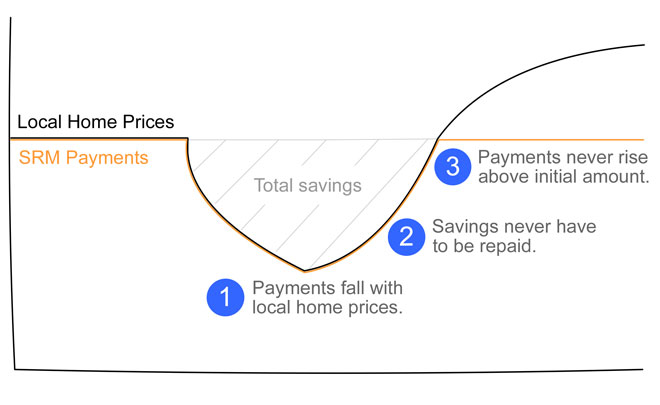

The SRM links your monthly payments to a local housing market. A 20% loss in your local market will mean a 20% reduction in your monthly payments. You can receive up to 80% in monthly payment savings with your SRM.

Your payments can be reduced but will never be increased above their initial amount. The SRM only adjusts payment when local home prices have fallen below their original value.

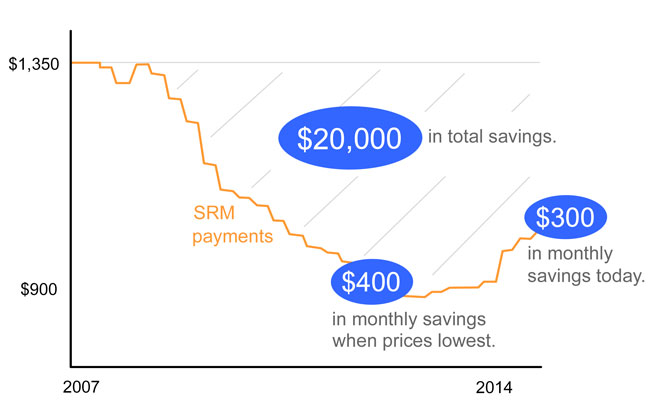

An SRM borrower living in Chicago with a $220,000 mortgage at 6.15% (common for 2007) would have saved $20,000 in total. Plus, the savings would still be taking place since prices have not fully rebounded from 2007.

You receive a credit when your local market is below its original value. No additional payment is due and there are no hidden costs throughout the life of the mortgage.

Over the course of a month, we presented the SRM to 40 prospective borrowers. 4 out of 5 said that they prefer the SRM over a typical mortgage and more...

"The SRM better understands my situation in this economy as a homeowner."

"The SRM still benefits me in the long run but also gives me a sense of security."

"The SRM is better because it is more flexible."

The Shared Responsibility Mortgage was first proposed by financial economists Atif Mian and Amir Sufi in their book, House of Debt. Their research into The Great Recession detailed the impacts of mortgage debt on consumption and led them to propose the Shared Responsibility Mortgage to prevent future housing market crises.

Inspired by Sufi and Mian's vision for a better housing market, PartnerOwn is taking the Shared Responsibility Mortgage from a policy proposal to a mortgage product that people can use to finance their next home purchase.

Shima worked in Deutsche Bank’s Structured Credit Group and in venture capital. She believes the SRM is a market based solution that better aligns the interests of borrowers and lenders and removes the need for costly guarantee fees.

Shima received her B.S. in Computer Science and Electrical Engineering from the Massachusetts Institute of Technology and her M.B.A. from the University of Chicago Booth School of Business.

Dylan worked as a research assistant for House of Debt. The authors' message resonated with his experience of teaching in West Garfield Park, a Chicago neighborhood struggling under the weight of the subprime lending crisis. He believes the SRM is better because it helps stabilize local housing prices and offers borrowers and investors a frictionless modification process.

Dylan received his B.S. in Computer Science at University of Illinois Urbana-Champaign and his M.B.A. from the University of Chicago Booth School of Business.

No. You will have access to competitive market interest rates.

We are currently working with Chicago based lenders to provide the SRM. If you are interested in another city, please email us.

Your period's index will be determined on a quarterly basis. As a result, you will know your montly payments for the next 3 months to help you budget.

Your reduction in payments will come from your interest. This will reduce the amount of mortgage interest you can deduct from your taxes but not add an additional tax burden. Your lender will provide you with a statement each tax year to notify you of such information.